Taxes

Introduction to taxes

In the setup of a new store, 3 elements should be taken into consideration as these elements define the exact tax rate you will charge.

|

Location of seller |

Depending on the location (country and state) of his business a seller may charge sales taxes or a value added tax. That's why in Summer Cart admin panel you can create your exact tax type. |

|

Type of products sold |

Some products are taxable, others non-taxable or get charged at a reduced rate. That's why is Summer Cart admin panel you can create your specific tax classes and group products according to their tax burden. |

|

Destination of shipment |

A store owner may ship only within his country, or within his state, but another may ship internationally. That's why in Summer Cart admin panel you can create your specific tax zones depending on where you ship to. |

The four components of a tax

In the Summer Cart admin panel a tax includes 4 components.

|

What a tax includes |

What is it for? |

|

Tax type |

Sales of products and services are charged by different taxes depending on the country's fiscal policy. In some countries the government levies a sales tax, while in others a VAT (value added tax). |

|

Tax class |

A group of products and services that attracts a certain tax rate. |

|

Tax zone |

A geographical region for which a certain tax goes into effect. |

|

Tax rate |

Tax rate is calculated on the basis of a tax class and a tax zone. |

| Tip: |

In Summer Cart store front taxes appear alongside product prices on Order Total price sheet. Read more in Order Total Modules. |

|---|

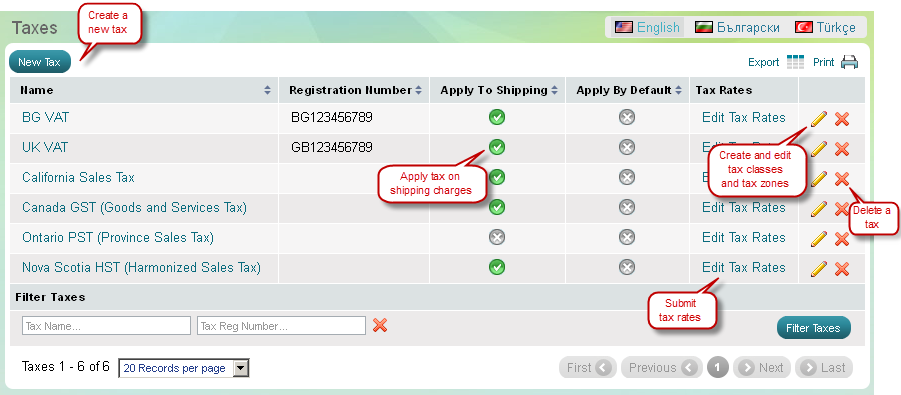

How to manage taxes in the Summer Cart store

>> Open Summer Cart admin panel

>> Go to the Settings menu, under 'Locations and Taxes' click on Taxes link.

Use 'Taxes' page to create and apply tax on your sales in 4 easy steps. See Quick guide.

At 'Taxes' page you can view, edit and delete taxes; manage the components of a tax - tax classes, tax zones and tax rates; sort and filter taxes by name and registration number.