Use case - Canada taxes

How to set up Canadian taxes

Note 1: If you sell taxable goods and services in Canada, you have to charge and remit GST (Goods and Services Tax) or HST (Harmonized Sales Tax) to the federal government.

Note 2: You will also have to charge and remit the provincial sales tax (PST or RST) in your “home” province if you are selling taxable goods and/or services. It's recommended that you check the PST rules in your province because of the complexity of what’s taxable and what’s not.

Step 1: Create 'GST' or 'Goods and Services Tax'

Let's create GST. If you want to create 'Provincial Sales Tax' and 'Harmonized Sales tax', follow the same instructions.

- Go to the Settings menu, under 'Locations and Taxes' click on Taxes link. 'Taxes' page appears.

- Click on 'New Tax' button on top of page. 'Create tax' page appears.

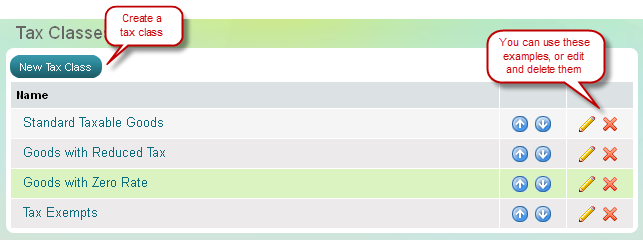

Step 2: Create tax classes

A tax has to include one or more tax classes.

- Once you have created a new tax, go to 'Edit tax' page.

- Click on 'New tax class' button in the middle of the page.

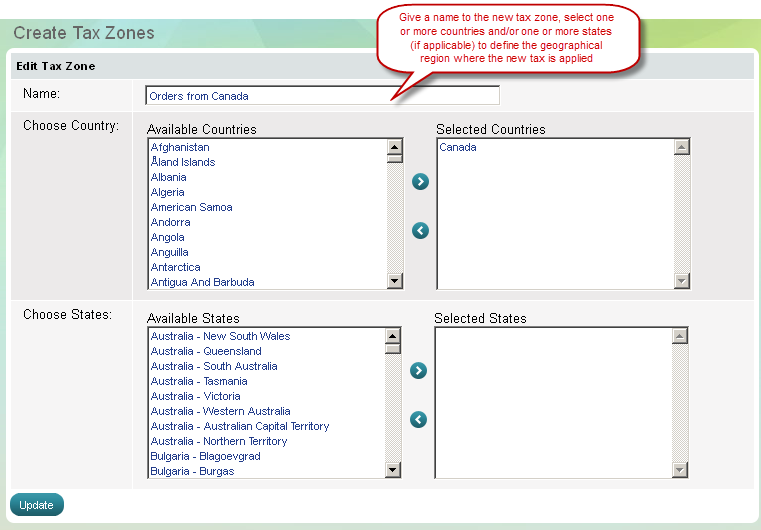

Step 3: Create tax zones

A tax has to include one or more tax zones. A tax zone may include more than one countries or more than one states and provinces.

- Once you have created tax classes, go to 'Edit tax' page.

- Click on 'New tax zone' button in the middle of the page. 'Create Tax Zones' page opens.

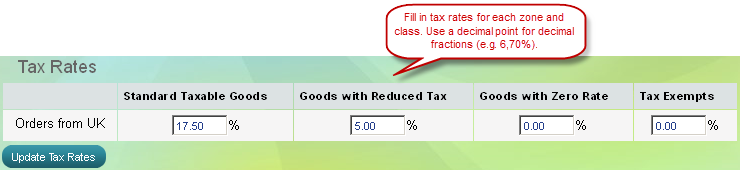

Step 4: Set tax rates

Define tax rates per each tax zone and tax class. If you have one tax zone and one tax class you will submit one tax rate.

- Go to the Settings menu, under 'Locations and Taxes' click on Taxes link. 'Taxes' page appears.

- Find the tax you have just created and click on Edit rates link.

Note 3: The content of Summer Cart Help does not constitute tax advice and recommendations. Tax information provided in Summer Cart Help is for demonstration purposes only about Summer Cart shopping cart functionality.