Use case - UK taxes

How to set up UK taxes

Note 1: UK merchants are required by law to collect VAT on items sold to UK customers and on products dispatched to countries within the European Union.

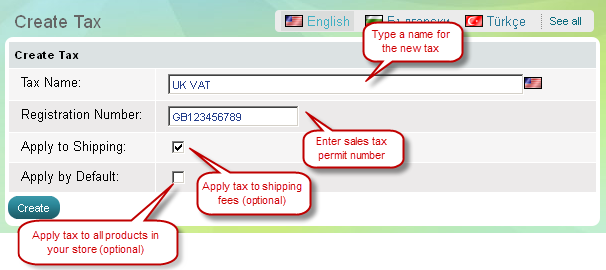

Step 1: Create a tax

- Go to the Settings menu, under 'Locations and Taxes' click on Taxes link. 'Taxes' page appears.

- Click on 'New Tax' button on top of page. 'Create tax' page appears.

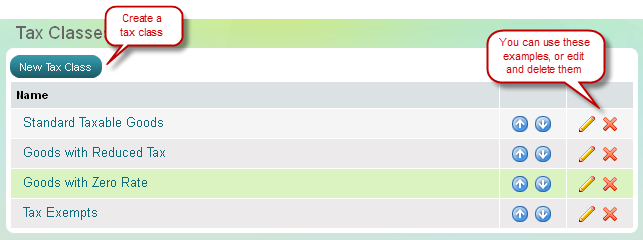

Step 2: Create tax classes

A tax has to include one or more tax classes.

- Once you have created a new tax, go to 'Edit tax' page.

- Click on 'New tax class' button in the middle of the page.

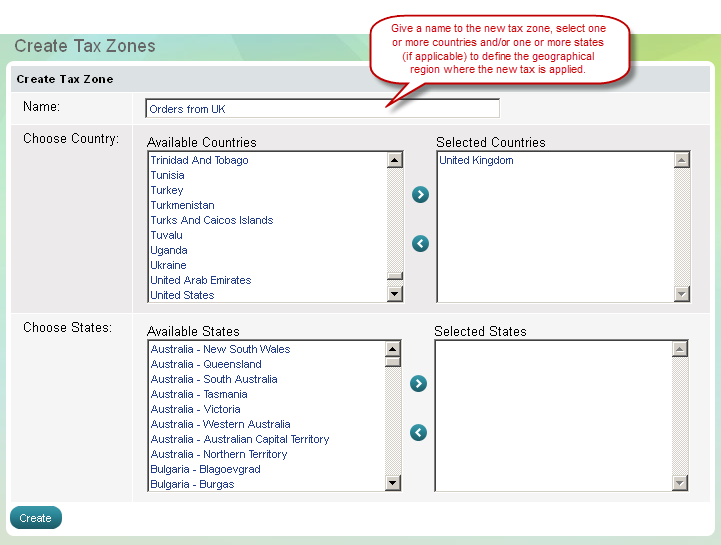

Step 3: Create tax zones

A tax has to include one or more tax zones. A tax zone may include more than one countries or more than one states or provinces.

- Once you have created one or more tax classes, go to 'Edit tax' page.

- Click on 'New tax zone' button in the middle of the page. 'Create Tax Zones' page opens.

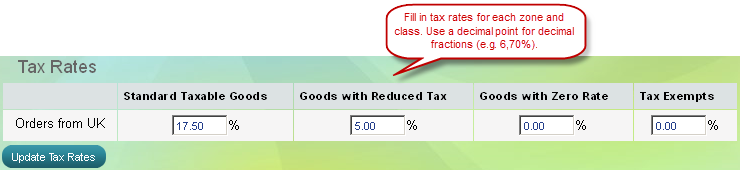

Step 4: Set tax rates

Define tax rates per each tax zone and tax class. If you have one tax zone and one tax class you will set one tax rate.

- Go to the Settings menu, under 'Locations and Taxes' click on Taxes link. 'Taxes' page appears.

- Find the tax you have just created and click on Edit rates link.

Note 2: The content of Summer Cart Help does not constitute tax advice and recommendations. Tax information provided in Summer Cart Help is for demonstration purposes only and refers to Summer Cart shopping cart functionality.